How to apply for PMEGP loan in indian government?

What is PMEGP Scheme?

PMEGP abbreviation is Prime ministers employment generation programme launched by Prime Minister Modi. It is a central government scheme only for new enterpreneurs who wants to start business or companies. If your project will be approved by government then you can get a loan maxiumum amount of 25 lakhs. It is a subsidy based scheme, the subsidy will start from 15 % to 35% of total approved project cost.

What are the documents required to apply PMEGP loan?

1. Prepare a detailed project report about your business or company

2. Arrange the place where do you want to start a company

3. Register your application in online in KVIC website

4. After registered the application in online then the KVIC authority will call for interview to choose the nodal agency for your loan.

5. It is important that before go for interview, you should talk to your desired bank who is ready to give loan for your project.

6. You should get official letter from bank manager and submit to KVIC authority.

7. If the KVIC committee will approve your project then they will forward official letter to concern bank manager.

8. Submit all the documents to bank manager.

9. The bank manager will start official process for your application and then they will do inspection of your project place in person.

10. If the bank manager approved your project then they will give approval letter for your project then you should submit the letter to KVIC/KVIB/DIC.

11. You should get EDP training programme

12. Submit the EDP training certificate to KVIC/KVIB/DIC and the concerned bank.

13. Your subsidy details will be sent to the bank by the government.

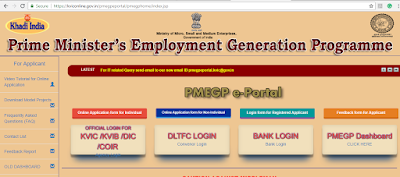

If you want to know more details about PMEGP then please click the below link https://kviconline.gov.in/pmegpeportal/pmegphome/index.jsp

Please see the below image for detail information

Thanks for reading my blog posts,

If you have any doubt then please leave your comments below the post…,

Comments

Post a Comment